Contracting out of the State Additional Pension and Guaranteed Minimum Pension

The Social Security Pensions Act 1975, which came into effect on 6 April 1978, provided for the State Retirement Pension to be related to the earnings on which National Insurance contributions were paid.

From 6 April 2016 new State Pension arrangements came in to force for people reaching State Pension age on or after this date. The information, below, applies to pension scheme members who reached State Pension age before 6 April 2016 and explains how the Guaranteed Minimum Pension element interacts with your scheme pension and your state pension.

State Additional Pension

During the period between 6 April 1978 and 5 April 2016 the state retirement pension consisted of two parts:

- A basic pension, and

- An additional earnings related pension which was known as State Earnings Related Pension Scheme (SERPS) or State Second Pension (S2P)

Until 6 April 2016 employees with a pension scheme which provided an approved alternative to SERPS /S2P, such as schemes administered by SPPA, were able to 'contract out' of paying extra National Insurance contributions for the additional State Pension.

Guaranteed Minimum Pension (GMP)

Between 6 April 1978 and 5 April 1997 occupational pension schemes could contract their employees out of the additional state pension as long as the scheme paid at least as much as they would have received under SERPS or S2P and this was known as the Guaranteed Minimum Pension.

This Guaranteed Minimum Pension element comes into effect when most scheme members reach State Pension age (although there are some exceptions such as members who were paying the married women’s rate of National Insurance).

You should note that the Guaranteed Minimum Pension is a component of the occupational pension – it’s not an additional sum added to your pension.

Both the State Pension and SPPA scheme pensions are protected against increases in the cost of living. This is known as index linking and shows on your payslip as Pensions Increase (PI).

The amount of the increase is set by the Government to keep pace with increases in the cost of living. However, part of the yearly increase applied to the scheme pension may, from State Pension Age, be paid with the State Pension and not by SPPA.

How the GMP element interacts with the State and scheme pension elements

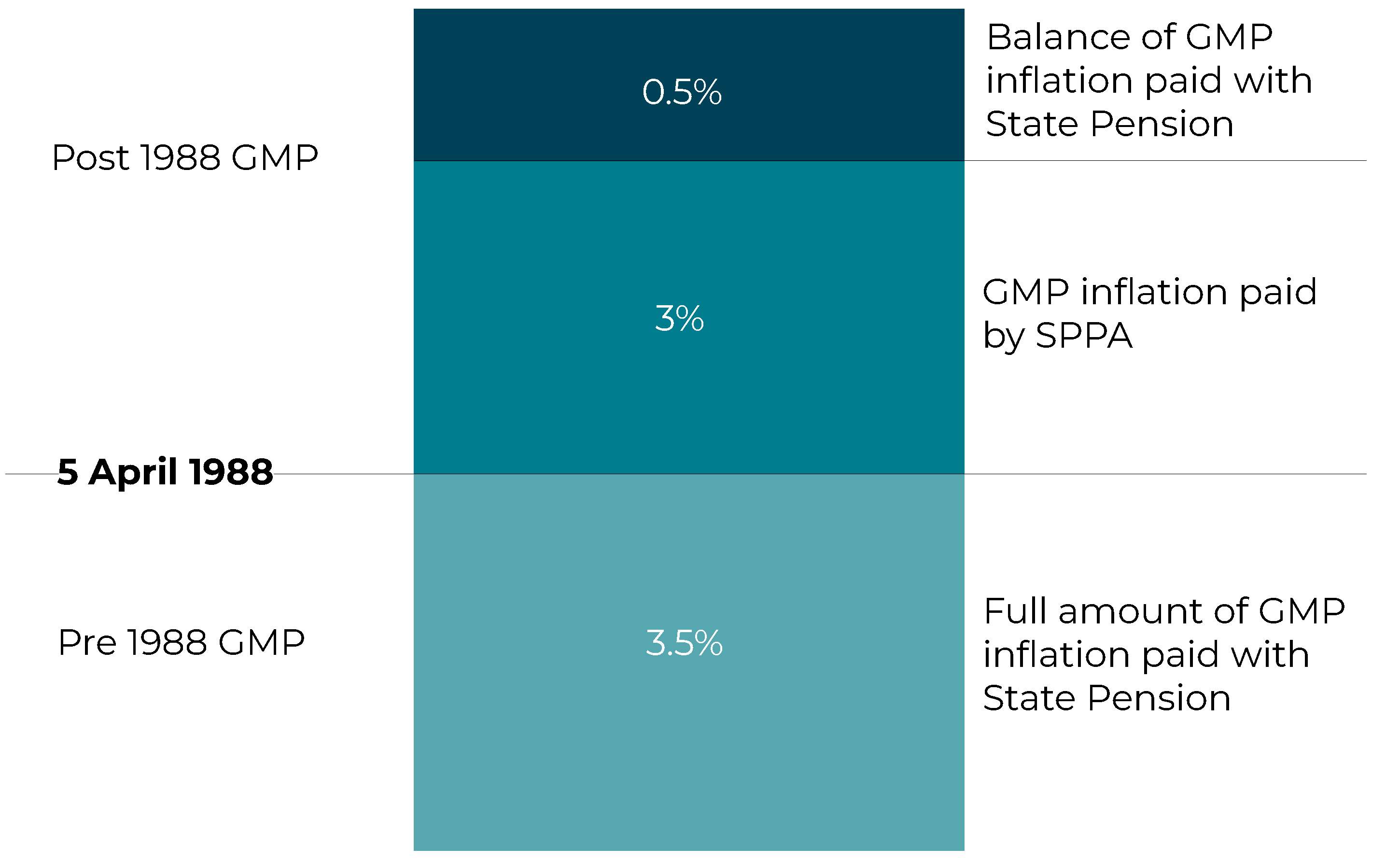

From 6 April 1988 changes in legislation meant the Guaranteed Minimum Pension elements before and after this date are calculated in different ways. In pensions’ terminology, scheme service from 6 April 1978 to 5 April 1988 is known as Pre-88 GMP, and service from 6 April 1988 until 5 April 1997 is known as Post-88 GMP.

For scheme membership from 6 April 1978 to 5 April 1988, when the Guaranteed Minimum Pension becomes payable, the inflation increase for the GMP element is paid along with the state pension.

For scheme membership from 6 April 1988 to 5 April 1997 the occupational pension scheme pays inflation increases up to a maximum of 3%. The remainder of the inflation increase over 3% is paid along with the State Pension.

The difference, between Pre 88 GMP and Post 88 GMP inflation increases, explains why the annual pension increase on a scheme pension is sometimes lower than the full percentage increase. Only certain components are increased by SPPA as is shown in the diagram below.

Guaranteed Minimum Pension percentages

The New State Pension and GMP Indexation from 6 April 2016

When the UK government introduced the new State Pension, from 6 April 2016, contracting out ended and the additional state pension was abolished. The new State Pension simplified the state pension system but, as a consequence, it removed the mechanism to apply indexation to pre 88 GMP, and post 88 GMP over 3%, for public service workers who reached their State Pension age from then onwards.

The UK government continued to meet its obligations to index the GMP elements by introducing an interim solution from 6 April 2016 to 5 April 2018, which was then extended to 5 April 2021. The interim solution ensured that, for those who reached State Pension age between those dates, all GMP elements within a pension received full indexation through the public service schemes. This meant that elements normally increased through the old State Pension were increased by the scheme pension instead.

Following public consultation, HM Treasury has decided that full indexation should become the permanent solution, which means that public service schemes will provide full indexation to scheme members with a GMP reaching state pension age from 6 April 2021.

Further information about the decision is available at the links below.

https://questions-statements.parliament.uk/written-statements/detail/2021-03-23/hcws871